Preparedness: How Scalepoint Advisors Empowers Early-Stage Companies

Aug 15, 2024

At Scalepoint Advisors, we specialize in providing fractional financial leadership to early-stage companies, many of which are venture-backed. For these companies, capital is not just important—it's the lifeblood that fuels their growth, particularly for lending companies.

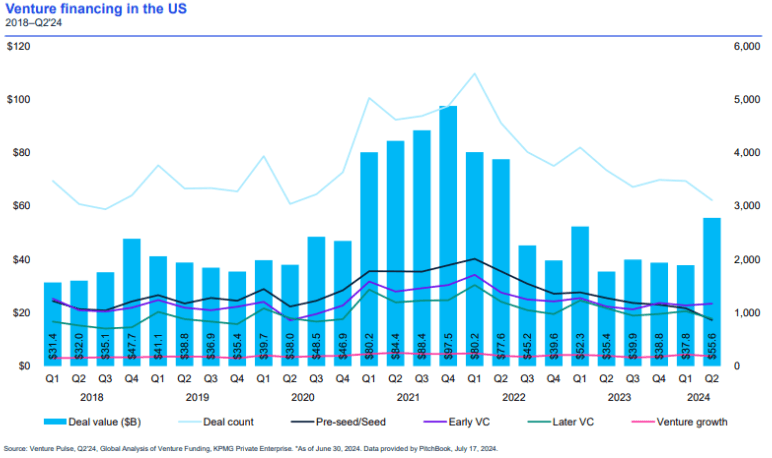

While the broader venture capital market is showing signs of a slight upswing, fintech VC investment remained relatively stable in the first half of 2024 at $7.3 billion, nearly identical to the $7.2 billion in the second half of 2023.

The Three-Legged Stool of Venture Investment

When venture investors evaluate an early-stage company, they focus on three key characteristics: market size, team, and product. These elements form the foundation upon which investment decisions are made.

In recent years, investors have also placed greater emphasis on understanding metrics such as Annual Recurring Revenue (ARR), unit economics, cash utilization, and time to break even. For founders, these are not questions that can be answered off the cuff. Thorough analysis and meticulous preparation are essential before engaging in these critical conversations.

How We Help

One of the most common reasons clients come to us is to prepare for a capital raise. Whether raising equity or debt, helping founders secure the funding they need is one of the most important services we offer—and we approach it with the utmost seriousness.

Our process for capital raise preparation is comprehensive, falling into four key categories:

In-Depth Business Analysis: We conduct a rigorous analysis to understand the business inside and out.

Three-Statement Pro-Forma Model: We prepare a working model that reflects the company’s financials, enabling scenario planning.

Scenario Planning: We build scenarios to account for various unknowns, helping to stress-test the model.

Capital Raising Strategy and Narrative: We work with the founders to develop a capital-raising strategy and narrative that aligns with the business’s economics and model.

Step 1 is crucial. We take a disciplined approach to learning about our clients' businesses, employing a nine-point assessment process that allows us to dive deep into the details. This helps us provide meaningful advice and support. As Peter Drucker famously said, “You can’t manage what you don’t measure.” We take this to heart, painstakingly understanding the inputs that drive business outcomes.

Brick by Brick

Our approach to understanding a business is methodical and thorough—we dig in brick by brick. This means not only learning from the operators but engaging in a dialogue where we test assumptions, share experiences, and anticipate future challenges.

Customer acquisition costs and channels are a particular focus. Every founder believes their acquisition costs will decrease with scale, and our job is to quantify that dynamic, support it with data, and identify what needs to happen to achieve those goals.

Understanding sales pipelines, marketing spend, and their impact on revenue growth is critical. We rigorously test assumptions about growth and costs, building realistic models that reflect the complexities of scaling a business. Where applicable, we even integrate CRM systems with the pro-forma to ensure a cohesive and data-driven approach.

Key Outputs: Unit Economics, Revenue, and Cash Burn

The outputs of our work vary, but three key areas are always in focus: unit economics, revenue (both growth and attribution), and cash burn. A company can survive many challenges, but running out of cash is not one of them. By analyzing these metrics, we develop scenarios around break-even points—milestones that every company aims to reach as quickly as possible.

We explore multiple paths to break even, considering various timelines and market conditions. This helps operators understand the financial resources, risks, and requirements necessary to reach the next level.

Preparing Both the Team and the Model

At Scalepoint Advisors, we do more than prepare financial models—we prepare teams for the journey ahead. Our rigorous process helps operators emerge stronger, more confident, and better equipped to navigate the financial trajectory of their company.

This is the work we love. Through our deep inquiry and collaborative approach, we empower operators to understand their businesses better, prepare for the market, and take the next steps toward growth with confidence.