Past is prologue. The second quarter of 2024 is looking up

Mar 27, 2024

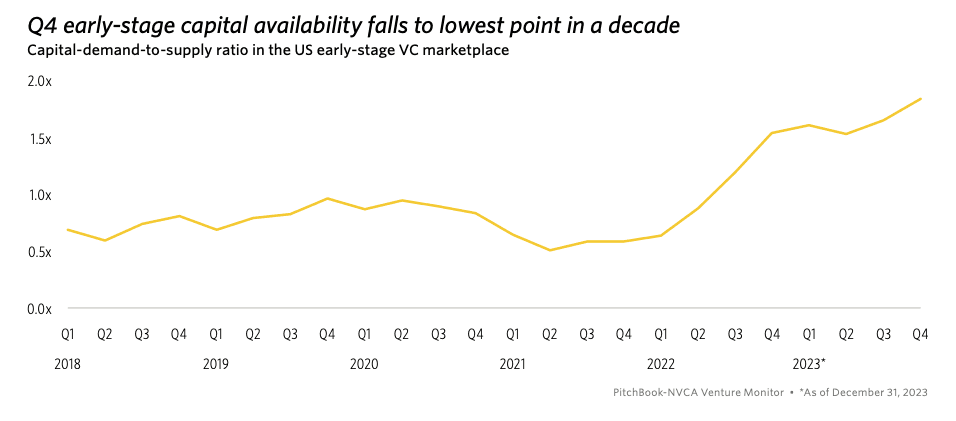

Past is prologue; the operating environment for early stage fintech, proptech and insurtech companies remains challenging but not without some glimmers of hope and encouragement on the horizon. The market is still coming to terms with the consequences of peak valuations and an active venture market in 2021 and into 2022. In 2021, roughly 800 companies in fintech raised a series A. Some of these companies, roughly 250, went on to raise a B, a small number did some M&A, which the balance is somewhere between waiting, bridge and out. Estimates are that roughly 40% of this cohort is in some form of “waiting”.Scalepoint Advisors is actively working with several companies in this uncomfortable waiting period and we’ve learned alot from our work. Here are a few important learnings.

Strategic partnerships are on the rise

First, strategic partnerships are very en vogue this season. These arrangements, which often provide an operating capital lifeline to our companies, also serve as win-win arrangements that complement both parties, help offset cost of client acquisition, increase lifetime value of the client relationship, and of course, drive top line growth.

Second, “strategic partner” is a subjective term. A company becomes strategic when they hear a well crafted articulation of what a particular partner will have a meaningful impact on their business. In a sense, it's our job to make that light-bulb go on, and when we do, meaningful conversations happen.

Third, strategic partners (non VC, operating companies) are clearly receptive to these conversations and welcome the opportunity to see new avenues for growth. Whereas in the recent past they have been crowded out and put off by high valuations, in today’s market they see strategic partnerships as a way to get access to amazing platforms, talent, and ideas.

When a company comes to the conclusion that a strategic partnership is the best way forward, difficult decisions need to be made around potentially lower valuations, greater dilution, change in governance, and a meaningfully different outcome for founders and early employees. The toll on the team is real.

It's hard work because there is a lot at stake and no matter the outcome, you have to play right up until the buzzer.

The graduate level class on resilience is in session. Take notes.

The human effect of this was recently highlighted by one of today’s most well known operators, Jensen Huang, when he shared this sentiment recently in front of a group of Stanford students and wished them “ample doses of pain and suffering”.

“And, unfortunately, resilience matters in success,” he said. “I don’t know how to teach it to you except for I hope suffering happens to you.” - Jensen Huang, CEO & Founder of Nvidia.

If short cuts always worked, they would just be the way.

But valuations and bloated preferred stakes are only one issue. As we observe the one year anniversary of the banking crisis of 2023, when three banks needed to be rescued, the regulatory overlay is creating a whole other set of consternation for fintech companies. It's ironic that the neglectful asset liability management on the part of experienced bankers has precipitated a regulatory chill in banking as a service. We think about this as a detour rather than a dead end but it has a cost. Baas models, partnered with banks, were supposed to be high speed lanes for fintechs approaching the market. The delay and uncertainty caused by the new regulatory overlay creates a host of consequences.

Lessons were learned.

One lesson that comes back over and over again is that of “risk of a single point of failure”. In the low dispersion world that was marked by quantitative easing, things worked out, most of the time. In today's more normalized economic environment, outcomes vary. Belts and suspenders, while sartorially incompatible, suddenly look like good ideas.

In some cases, reducing a “single point of failure" means increasing (perhaps doubling) an already crushing workload. For some of our clients, it means continuing to source equity to feed a growing balance sheet, while also seeking out off-balance-sheet options such as forward flow agreements.

Sometimes, it's creating multiple partnerships at the top of the funnel to ensure that growth happens regardless of what happens with one partner or the other. This almost always means that the company needs more resources, sometimes multiple resources, a high level of coordination of these resources, all managed in a way that assures a high probability of successful outcome.

In these delicate situations, Scalepoint can play multiple roles including helping our founders and investors make the best decisions possible with the time and resources available to them.

One example is understanding and modeling the effect of a strategic transaction, the potential effect on the capital stack, operating runway and exit valuation.

On the partnerships side, our work is to amplify connectivity to logical potential partners. Research and outreach, focused on making meaningful and well thought out connections is critical.

Delivering carefully articulated presentations designed to catalyze conversations can get key partners to the table.

As always, we’re here to help.

Derek and Jeff